Fixed Premium Life Insurance

Life insurance can offer protection and flexibility to your financial strategy. The short answer is no.

When you buy a term policy you pay a fixed amount for coverage with a set expiration date.

Fixed premium life insurance. Term life insurance is a defined policy that guarantees a benefit payout if the covered person dies during the policy term. People make mistakes all the time. Single premium life spl is a type of insurance in which a lump sum of.

Often times you just want to make sure your family is protected in the case of your passing. In return the insurance company agrees that upon the death of the policyholder a payment will be made in the amount of the coverage to the person designated by the. A person known as the policyholder takes out a life insurance policy and pays money known as the premium.

Fixed term life insurance offers a death benefit to your beneficiaries if you die within a certain period. You can think of term life insurance as temporary life insurance. Allianz offers term insurance and fixed index universal life insurance.

Life insurance with fixed premium rates. Shopping for the best life insurance requires good research and careful thoughts. A life insurance premium is a payment made to the life insurance company to pay for a life insurance policy.

Premium can also contribute to growing the cash value of a permanent type of life insurance. Fixed life is another label for whole life which combines life insurance and savings into one account. The main benefit of life insurance is to create an estate that can provide for survivors or leave something to charity.

Read about the pros and cons of fixed coverage from five years to 30 year term life insurance in this post. Fixed premium life insurance quotes. Life insurance policies have two main categories.

It can be a good choice if you need basic death benefit protection and want level affordable premium payments. Understanding the different types of life insurance. The variety of life insurance products can often leave you the consumer a little confused.

This term is also applied to payments remitted for annuity contracts both fixed and variable. Although all of these policies are single premium so youll always pay on lump sum up front with single premium whole life insurance you will receive a fixed interest rate on the return which is generally considered the safer less volatile choice. About flexible premium life insurance.

Realizing in the end that either they purchased a wrong policy or they cant keep it anymore because it turned into a financial burden.

Term Life Insurance English Smart Learning

Term Life Insurance English Smart Learning

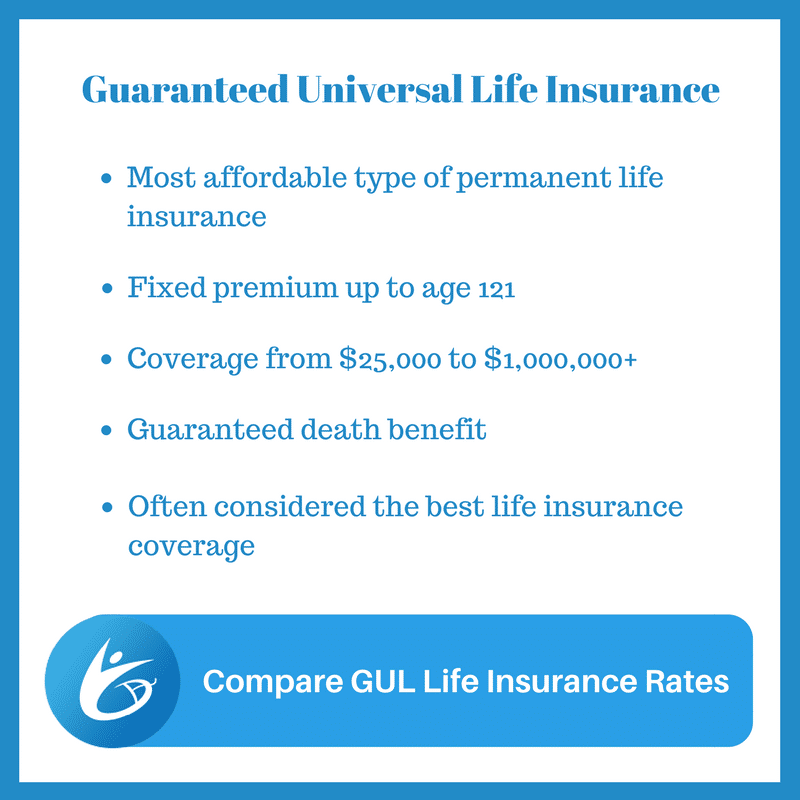

15 Best Guaranteed Universal Life Insurance Companies Reviewed

15 Best Guaranteed Universal Life Insurance Companies Reviewed

Universal Life Insurance Model Regulation Pdf Free Download

Universal Life Insurance Model Regulation Pdf Free Download

Tips In Getting Better Senior Life Insurance

Tips In Getting Better Senior Life Insurance

Insurance Life Permanent By Gale Hannah Issuu

Insurance Life Permanent By Gale Hannah Issuu

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

10 15 20 25 30 35 Year Term Life Insurance Lengths Which Is Best

10 15 20 25 30 35 Year Term Life Insurance Lengths Which Is Best

Lifeinsurancerate Fixed Premiums That Offer Stability

Lifeinsurancerate Fixed Premiums That Offer Stability

Divorce And The Benefits Of Life Insurance Divorce Dimensions Inc

Divorce And The Benefits Of Life Insurance Divorce Dimensions Inc

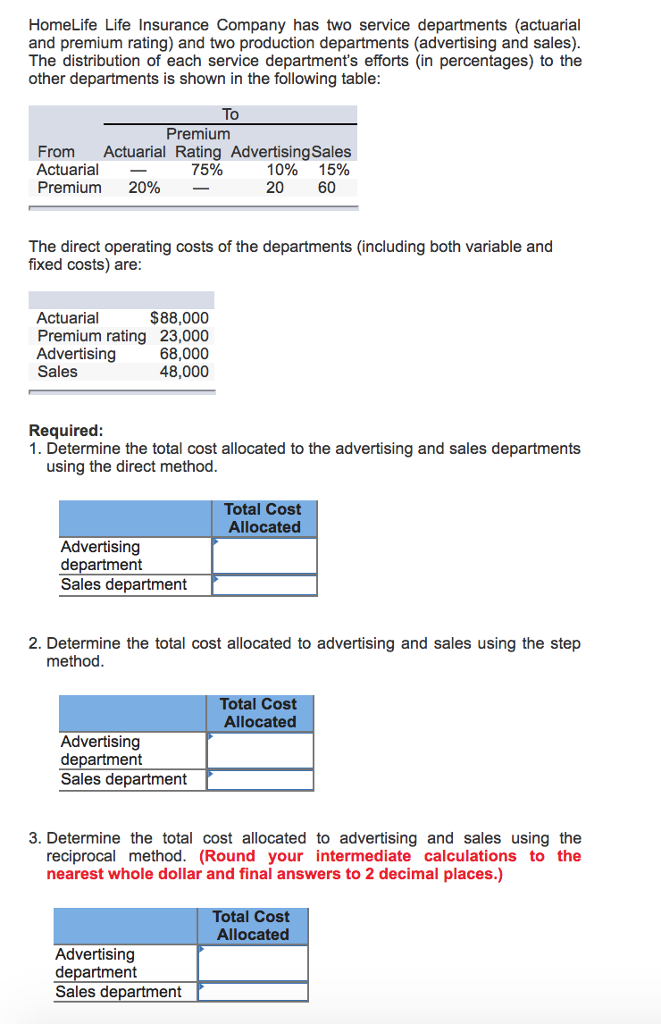

Solved Homelife Life Insurance Company Has Two Service De

Solved Homelife Life Insurance Company Has Two Service De

Guide To Do Universal Life Insurance Policies Work Life

Guide To Do Universal Life Insurance Policies Work Life

How To Control Your Life Insurance Premiums Text Vector Image

How To Control Your Life Insurance Premiums Text Vector Image

Life Insurance With Fixed Premium Rates What Are My Options

Life Insurance With Fixed Premium Rates What Are My Options

Term Life Insurance Definition

Term Life Insurance Definition

Universal Life Insurance Definition

Universal Life Insurance Definition

Aa Life Insurance 2020 Review Reassured

Aa Life Insurance 2020 Review Reassured

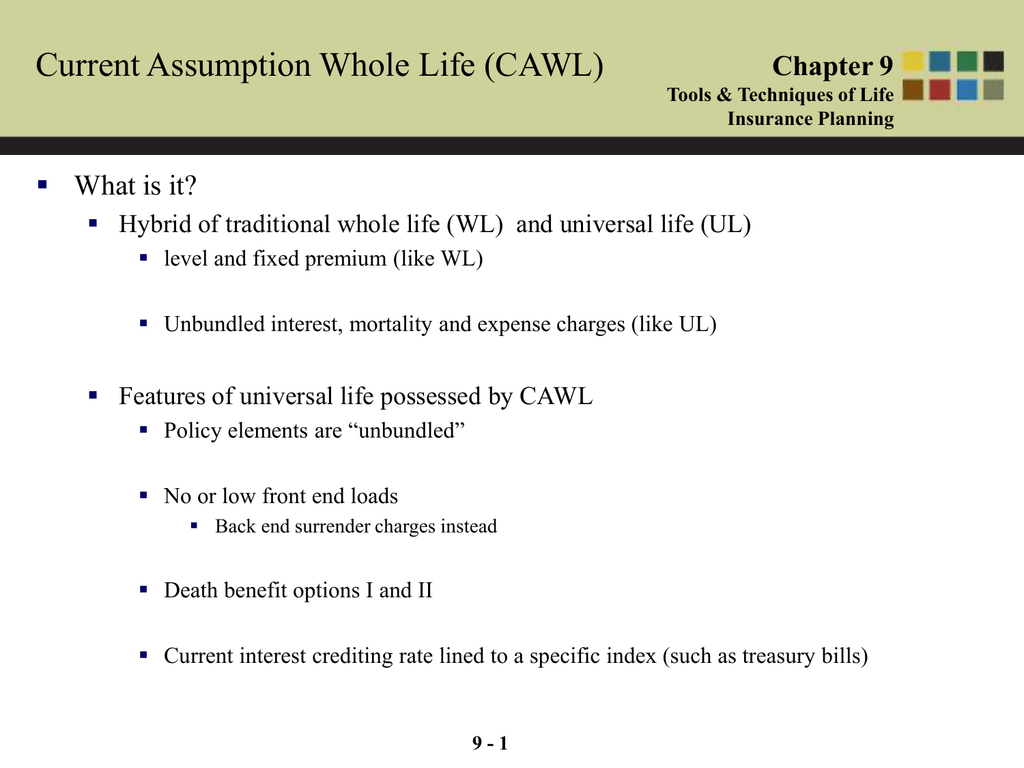

Chapter 9 Tools Techniques Of Life Insurance Planning 9

Chapter 9 Tools Techniques Of Life Insurance Planning 9

Universal Life Coverage Human Resource Management

Universal Life Coverage Human Resource Management

New Whole Life Insurance Quotes No Medical Exam Thenestofbooksreview

New Whole Life Insurance Quotes No Medical Exam Thenestofbooksreview

Whole Vs Universal Life Insurance Which One Is Better For You

Whole Vs Universal Life Insurance Which One Is Better For You

Chapter 10 In Class Notes Background On Life Insurance Parties To

Chapter 10 In Class Notes Background On Life Insurance Parties To

Post a Comment for "Fixed Premium Life Insurance"