Employer Paid Life Insurance Taxable

In quebec premiums for health and dental insurance are also considered a taxable benefit. A person whose employer provides him with 100000 in life insurance coverage by contrast has to pay taxes on part of it.

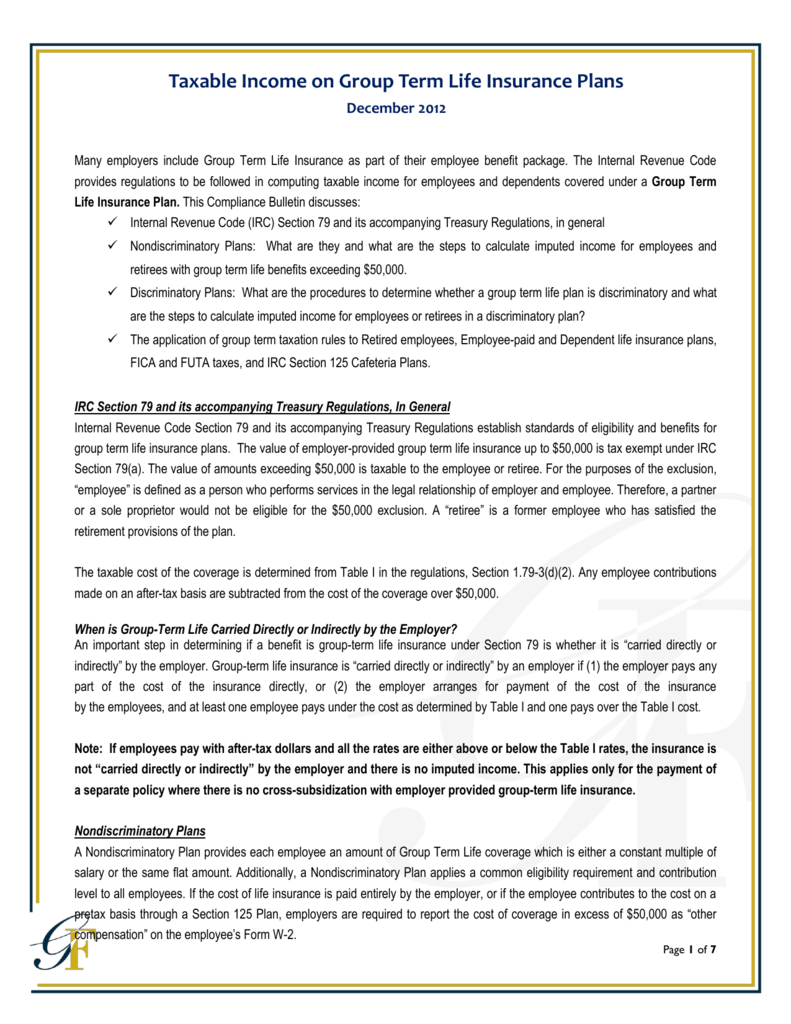

Taxable Income On Group Term Life Insurance Plans

Taxable Income On Group Term Life Insurance Plans

It most likely was a deduction for the s corp provided the s corp is the beneficiary of the policy.

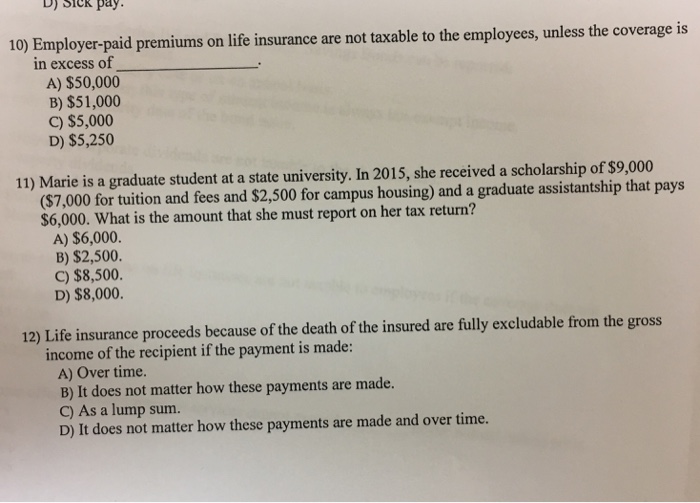

Employer paid life insurance taxable. Its listed in box 17 so that the s corp itself can show the deduction and what the deduction was for. Employer paid life insurance premiums covering the first 50000 in insurance are not taxable to you. But premiums your employer pays for any face amount of insurance over 50000 are treated by the internal revenue service as income paid to you and you will have to pay income tax on this amount.

It works in a sense like group health insurance. The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000. Employer paid life insurance may have a tax cost.

Term insurance is any life insurance under a group term life insurance policy other than insurance for which a lump sum premium has become payable or has been paid. Life insurance for current employees would usually be term insurance although it is sometimes provided for retired employees. Employer has taken up a group term life insurance policy for the employees who are not the named beneficiary.

Employer paid premiums for group life insurance dependant life insurance accident insurance and critical illness insurance are taxable benefits and the amounts paid on your behalf will be added to your taxable income. Employer paid term life insurance comes as an option through some employee benefits packages. In general the amount the employer must include is the amount by which the fair market value of the benefits is more than the sum of what the employee paid for it plus any amount that the law excludes.

There are other special rules that employers and employees may use to value certain fringe benefits. The premium cost for the first 50000 of life insurance coverage provided under an employer provided group term life insurance plan does not have to be reported as income and is not taxed to you. The premiums are not taxable if the employer policyholder has a choice or the discretion to decide whether he wants to disburse the insurance payout from the group insurance policy to the employee or his next of kin.

If the corporation paid for life insurance to insure your life thats just not a deduction on your personal tax return. The premium dollars that pay for the 50000 in coverage he receives in. This coverage is excluded as a de minimis fringe benefit.

An Introduction To Cafeteria Plans Permitted Tax Exempt And

An Introduction To Cafeteria Plans Permitted Tax Exempt And

When Insurance Premium Paid By Employer Is Perquisite When Not

When Insurance Premium Paid By Employer Is Perquisite When Not

Are Life Insurance Death Benefits Taxable Income Finance Zacks

Are Life Insurance Death Benefits Taxable Income Finance Zacks

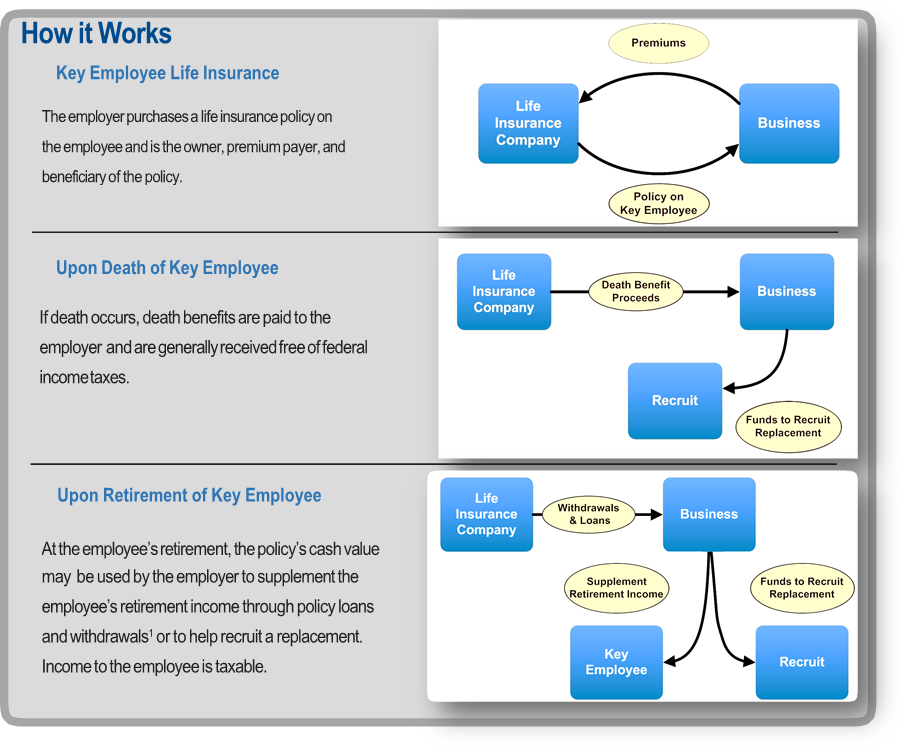

Key Employee Life Insurance Gulfport Ms Mayfield Associates

Key Employee Life Insurance Gulfport Ms Mayfield Associates

/patient-giving-nurse-medical-identification-card-in-clinic-603707297-578d3dd75f9b584d2022dd8b.jpg) Do Employers Reimburse Individual Health Insurance Premiums

Do Employers Reimburse Individual Health Insurance Premiums

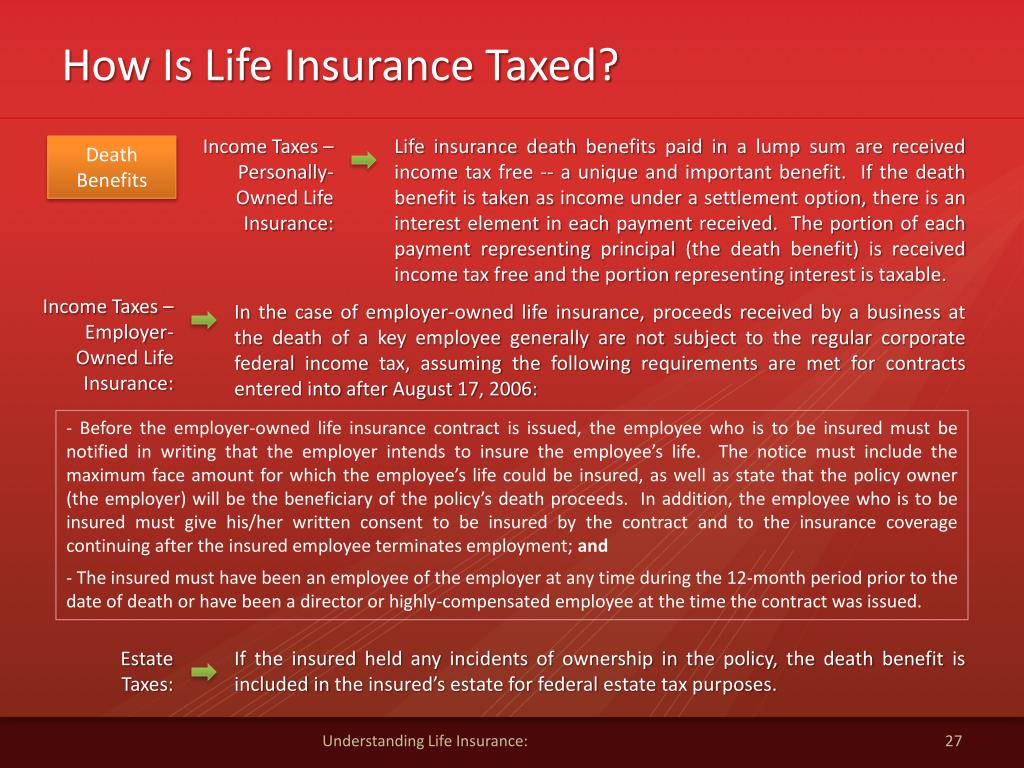

Ppt Understanding Life Insurance Powerpoint Presentation Free

Ppt Understanding Life Insurance Powerpoint Presentation Free

What Is A Section 125 Pop Premium Only Plan Gusto

What Is A Section 125 Pop Premium Only Plan Gusto

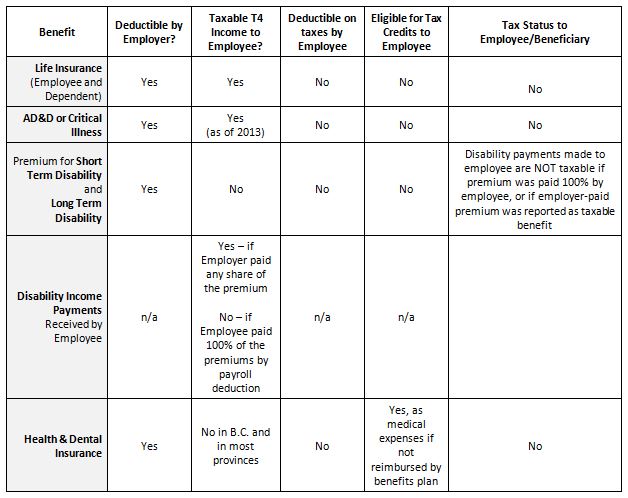

Rpp Benefits Taxation Of Benefit Plans

Rpp Benefits Taxation Of Benefit Plans

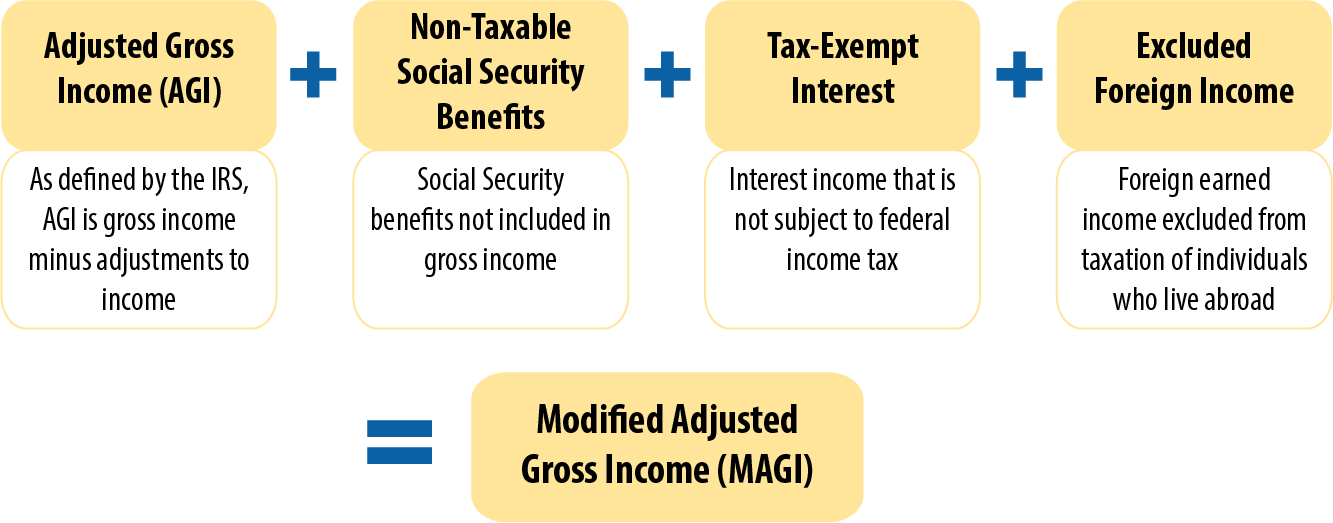

Key Facts Income Definitions For Marketplace And Medicaid

Key Facts Income Definitions For Marketplace And Medicaid

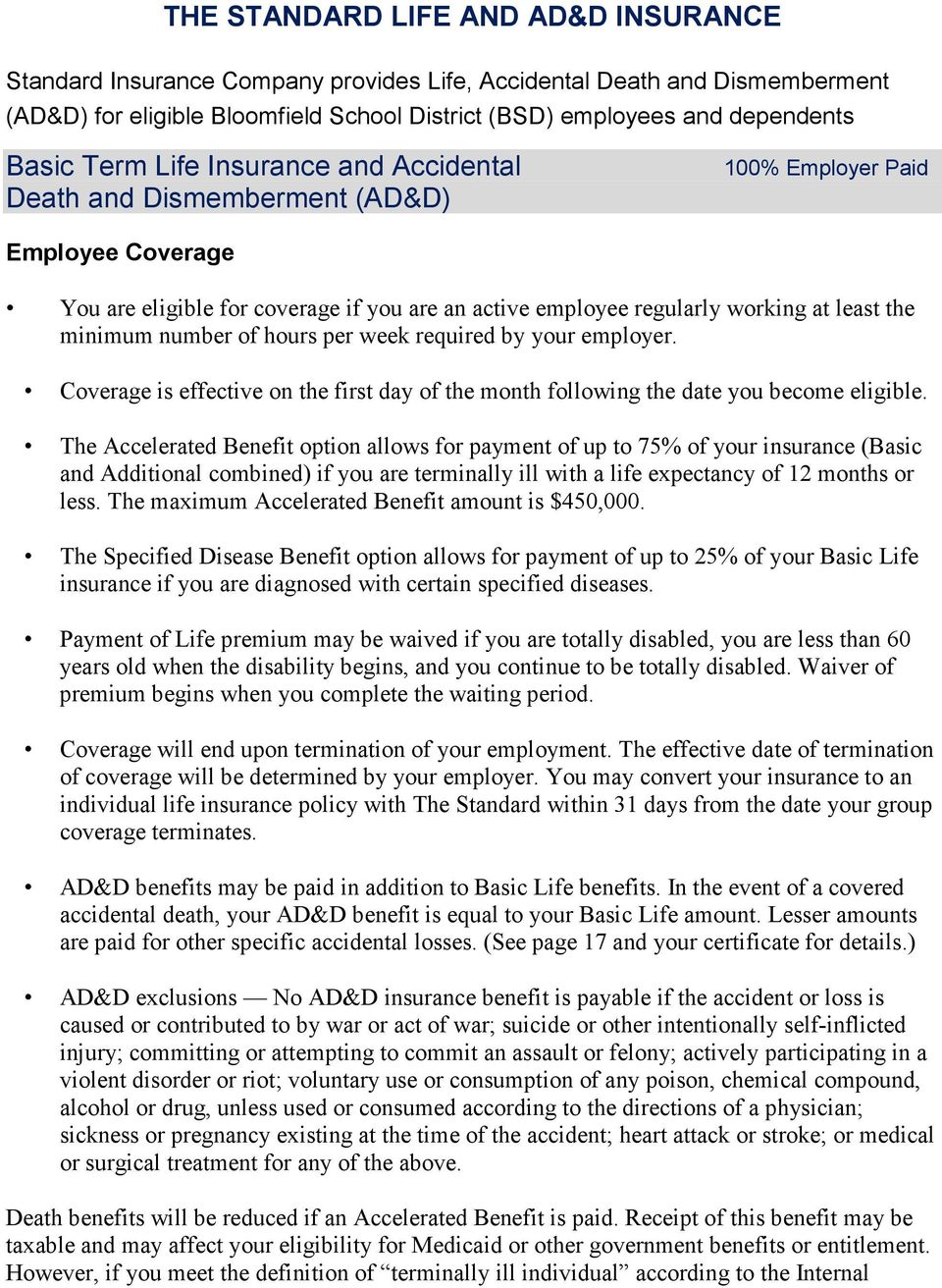

The Standard Life And Ad D Insurance Pdf Free Download

The Standard Life And Ad D Insurance Pdf Free Download

The Irs Helps Pay For Child And Dependent Care Costs Bankrate Com

The Irs Helps Pay For Child And Dependent Care Costs Bankrate Com

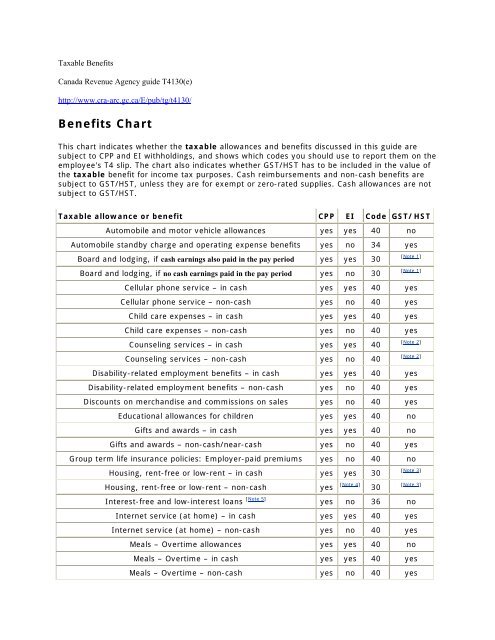

Canada Revenue Agency Guide T4130 E Addventive

Canada Revenue Agency Guide T4130 E Addventive

Why Am I Paying Employers National Insurance As An Umbrella

Why Am I Paying Employers National Insurance As An Umbrella

The Basics Of Employee Benefits Entrepreneur Com

The Basics Of Employee Benefits Entrepreneur Com

12 Top Sources Of Nontaxable Income

12 Top Sources Of Nontaxable Income

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

Retirement Investing Chapter 9 Pp Ppt Download

Retirement Investing Chapter 9 Pp Ppt Download

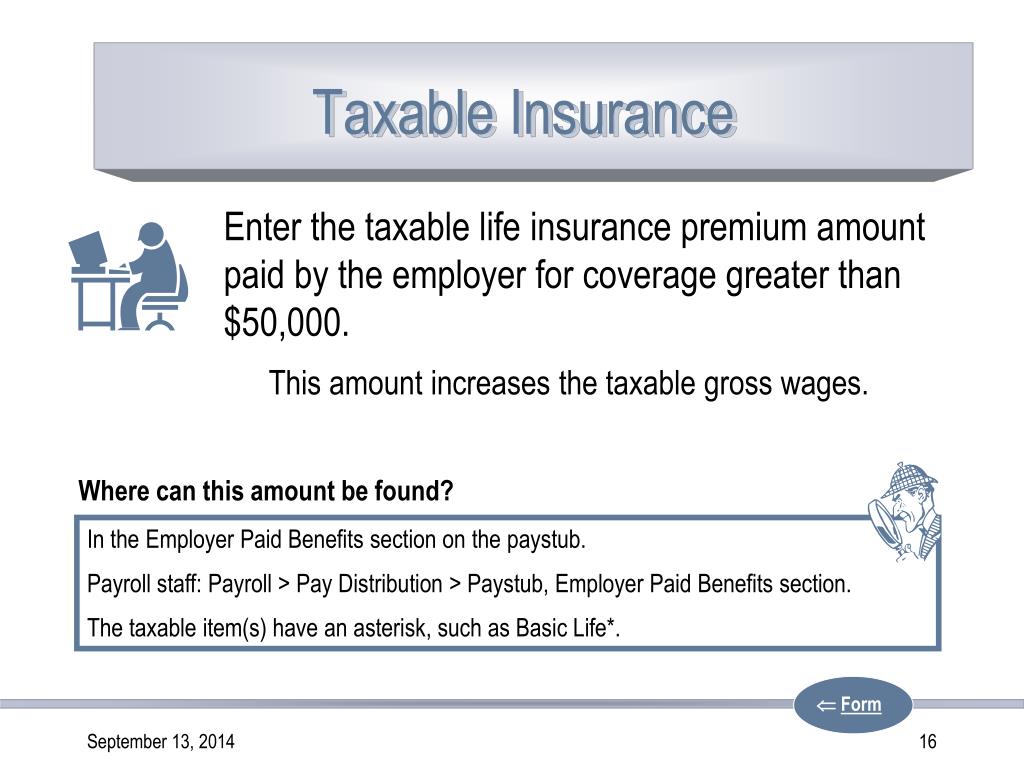

How To Check Your Pay 2019 By Wendell Head Ppt Download

How To Check Your Pay 2019 By Wendell Head Ppt Download

Benefits Behavior Spotlight On Group Life And Disability

Benefits Behavior Spotlight On Group Life And Disability

Net Pay Calculator Powerpoint Presentation Next Ppt Download

Net Pay Calculator Powerpoint Presentation Next Ppt Download

Post a Comment for "Employer Paid Life Insurance Taxable"