Do You Pay Taxes On Life Insurance Inheritance

Depending upon the size and structure of the payout this may feel like a sizable inheritance. Another way to save your family from having to sacrifice 40 of your assets to the tax man when you pass away is to dedicate a portion of your life insurance pay out to paying off the inheritance tax bill.

Simple Legal Ways To Avoid Inheritance Tax In Ireland Today

Simple Legal Ways To Avoid Inheritance Tax In Ireland Today

Are you taxed on inherited life insurance money.

/senior-woman-getting-advice-187044377-025ec7c8fcc44d6d97e12675cd08a87a.jpg)

Do you pay taxes on life insurance inheritance. However if the total value of your estate is more than 325000 inheritance tax iht will be deducted from your insurance pay out at a rate 40. Do the beneficiaries of life insurance have to pay inheritance tax. Posted mar 26 2018 the states inheritance tax is levied based on the relationship of the beneficiary to.

If you have taken out life insurance to provide a lump sum or regular income to your loved ones when you die there is usually no income or capital gains tax to pay on the proceeds of the policy. A main factors in deciding the taxabiity of this is who paid the premiums for the life insurance and whether or. Taxes on a individual life insurance policy is generally not taxable in any manner.

Any interest earned by the proceeds would be taxable however if the policy earns income after the date of death. The irrevocable trust must be the owner of your policy for at least 3 years at the time of death to avoid any estate taxes being assessed. If you decide to transfer a life insurance policy that you currently have into an irrevocable trust do not wait.

You dont have to pay income tax on the initial policy proceeds when youre the beneficiary of a life insurance policy. If youre named as the beneficiary of a life insurance policy you may expect a substantial windfall upon the death of the policyholder. Inheritance taxes may be levied against your life insurance proceeds depending on where you live.

Pay inheritance tax with your life insurance pay out. Updated jan 30 2019. States with inheritance tax policies take several factors into consideration when determining who.

Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. Though you dont pay these estate taxes directly as an inheritor they do have an impact on your inheritance by reducing the size of the estate that you are inheriting from. The internal revenue service doesnt consider death benefits to be income.

How Does A Life Insurance Policy Payout Work Haven Life

How Does A Life Insurance Policy Payout Work Haven Life

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable True Blue Life Insurance

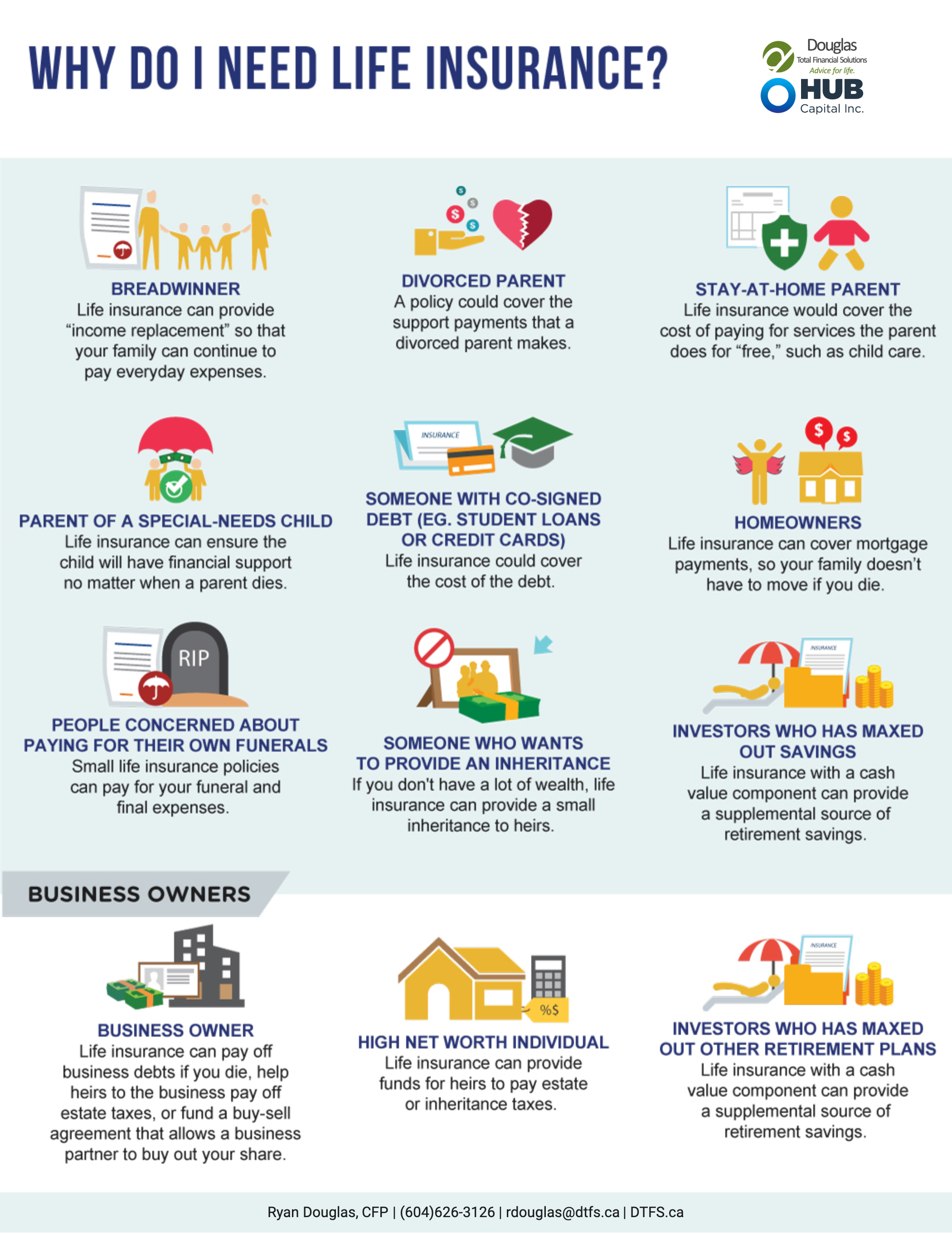

Do You Really Need Life Insurance

Do You Really Need Life Insurance

5 Ways To Use Life Insurance In Retirement

5 Ways To Use Life Insurance In Retirement

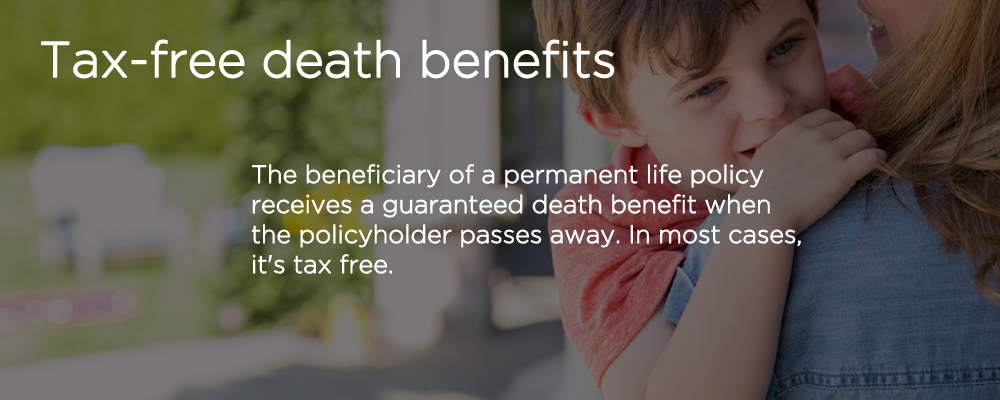

Benefits Of Permanent Life Insurance Nationwide

Benefits Of Permanent Life Insurance Nationwide

What About Inheritance Tax On Life Insurance Nn Belgium Insurance

What About Inheritance Tax On Life Insurance Nn Belgium Insurance

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Are Insurance Proceeds Taxable Income A Look At Tax Rules On

Are Insurance Proceeds Taxable Income A Look At Tax Rules On

/hispanic-saleswoman-talking-to-clients-in-living-room-580504711-5995f8d722fa3a001149763c.jpg) Life Insurance Death Benefits Estate Tax

Life Insurance Death Benefits Estate Tax

5 Uses For Life Insurance Benefits Allstate

5 Uses For Life Insurance Benefits Allstate

States With An Inheritance Tax Recently Updated For 2020

States With An Inheritance Tax Recently Updated For 2020

How To Avoid An Inheritance Tax Charge On Life Insurance Payouts

How To Avoid An Inheritance Tax Charge On Life Insurance Payouts

How Does Inheritance Work And What Should You Expect

How Does Inheritance Work And What Should You Expect

Can Life Insurance Pay For Inheritance Taxes Budgeting Money

Can Life Insurance Pay For Inheritance Taxes Budgeting Money

Is Life Insurance Taxable To The Beneficiary Youtube

Is Life Insurance Taxable To The Beneficiary Youtube

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And

Do The Beneficiaries Of Life Insurance Have To Pay Inheritance Tax

Do The Beneficiaries Of Life Insurance Have To Pay Inheritance Tax

Is Life Insurance Taxable An Important Beneficiary Guide

Is Life Insurance Taxable An Important Beneficiary Guide

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

/senior-woman-getting-advice-187044377-025ec7c8fcc44d6d97e12675cd08a87a.jpg) Tax And Other Consequences Of Inheriting A Pod Account

Tax And Other Consequences Of Inheriting A Pod Account

Post a Comment for "Do You Pay Taxes On Life Insurance Inheritance"