Cash In Value Life Insurance

Cash value life insurance can be strategically used to maximize the cash value and tax savings while recapturing debts for financing other necessary items such as vehicles real estate investing or business expenditures. Cash value life insurance offers liquidity since youre able to access your policy without a penalty and taxes before age 595 unlike a 401k ira or roth abrams says.

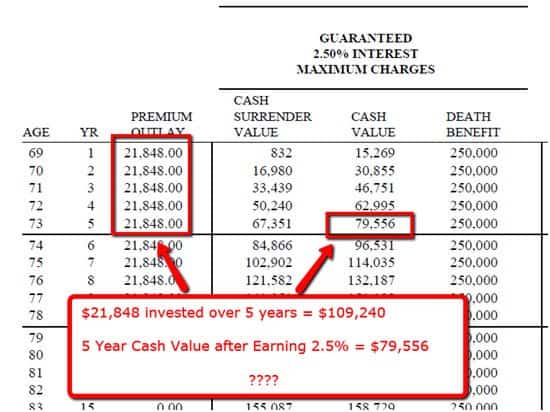

Limited Pay Whole Life Insurance What Is It See The Numbers

Limited Pay Whole Life Insurance What Is It See The Numbers

Cash value has a nice ring to it when youre thinking about buying life insurance but youll need to do some careful analysis to learn whether a cash value policy is.

Cash in value life insurance. A portion of that 100 covers the cost of actually insuring your life and the rest is put into investments by the insurance company. The policyholder can use the cash value for many purposes such as a source of loans. Cash value life insurance is a form of permanent life insurance that features a cash value savings component.

The choice can have a number of financial implications including tax liability. These deposits are held in a cash accumulation account within the policy. Cash value builds up in your permanent life insurance policy when your premiums are split up into three pools.

The most direct way to access the cash value in your policy is to make a withdrawal from it. Cash value works like this. There are cons though.

Cash value life insurance such as whole life and universal life builds reserves through excess premiums plus earnings. You must qualify for a policy which usually requires a health exam. You can do this by notifying your life insurance carrier that you would like to take money out of your policy.

While income replacement is the primary purpose of life insurance many policyholders tap into cash value life insurance for other reasons such as building a nest egg for retirement. Say youre paying 100 a month for your cash value life insurance policy. One portion for the death benefit one portion for the insurers costs and profits.

Here are some factors to consider before. Whether to cash in a life insurance policy is an important decision.

Csvli Cash Surrender Value Life Insurance In Business Finance

Csvli Cash Surrender Value Life Insurance In Business Finance

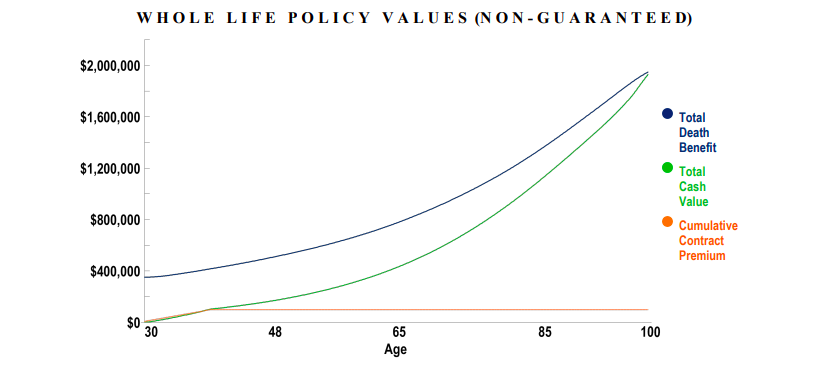

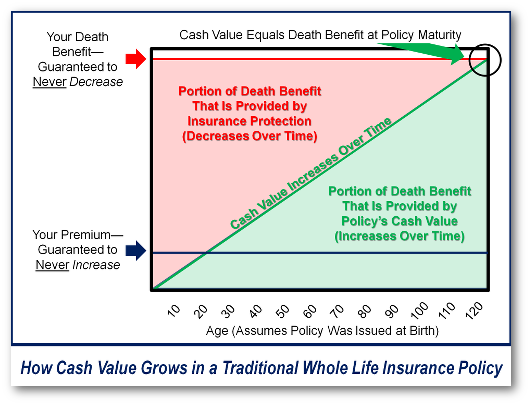

How Does The Whole Life Insurance Cash Value Increase Over Time

How Does The Whole Life Insurance Cash Value Increase Over Time

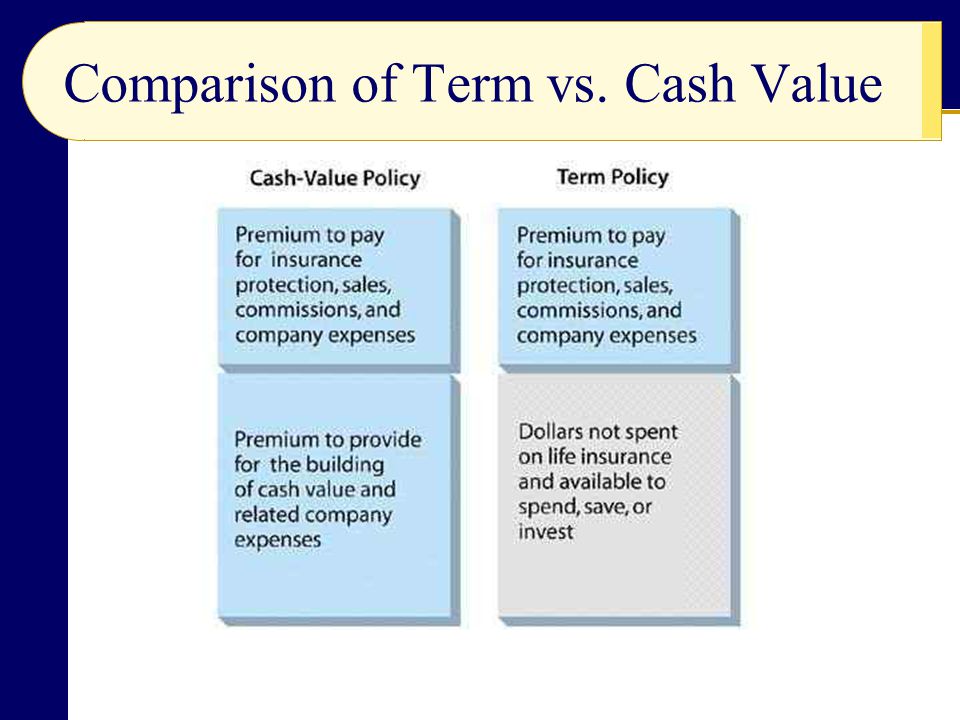

Chapter 12 Life Insurance Planning Ppt Download

Chapter 12 Life Insurance Planning Ppt Download

How To Make Your Cash Value Life Insurance Policy Work For You

How To Make Your Cash Value Life Insurance Policy Work For You

Top 100 Universal Life Insurance Quotes Online Instant

Top 100 Universal Life Insurance Quotes Online Instant

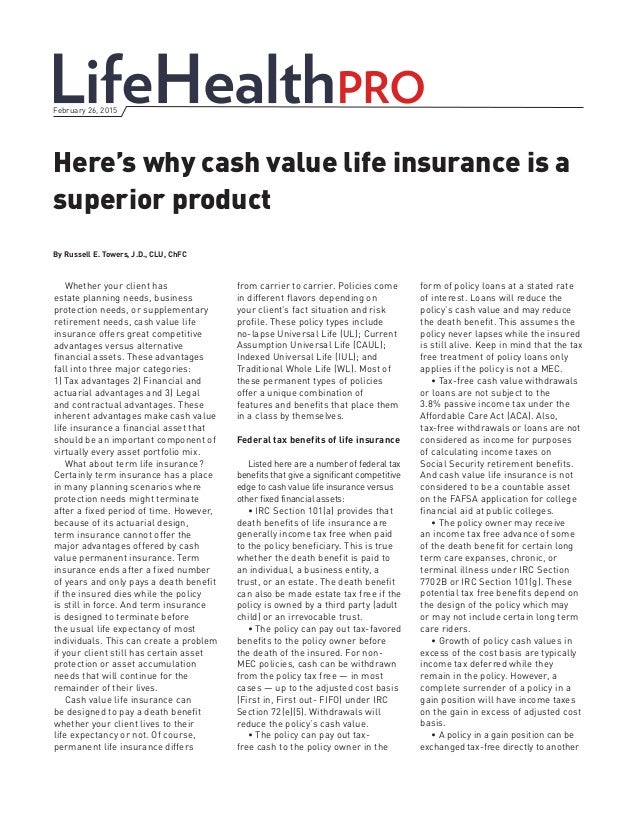

Lifehealthpro Heres Why Cash Value Life Insurance Is A Superior Pro

Lifehealthpro Heres Why Cash Value Life Insurance Is A Superior Pro

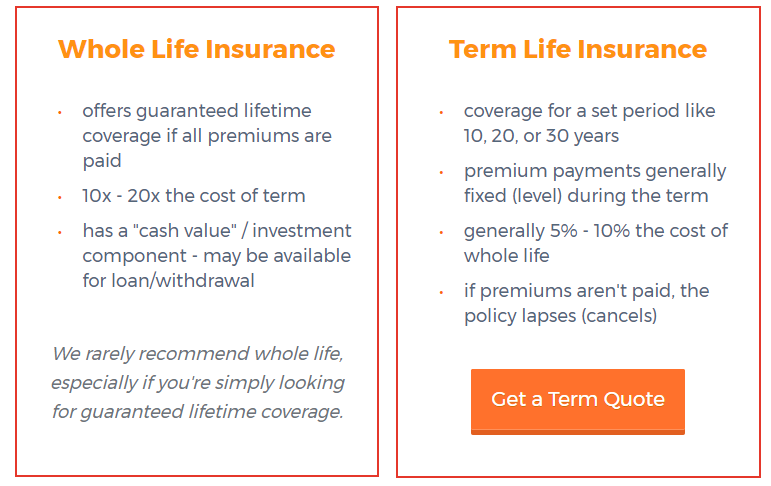

Term Versus Whole Life Insurance

Term Versus Whole Life Insurance

Whole Life Insurance How It Works

Whole Life Insurance How It Works

How To Calculate Cash Surrender Value Of Life Insurance Life

How To Calculate Cash Surrender Value Of Life Insurance Life

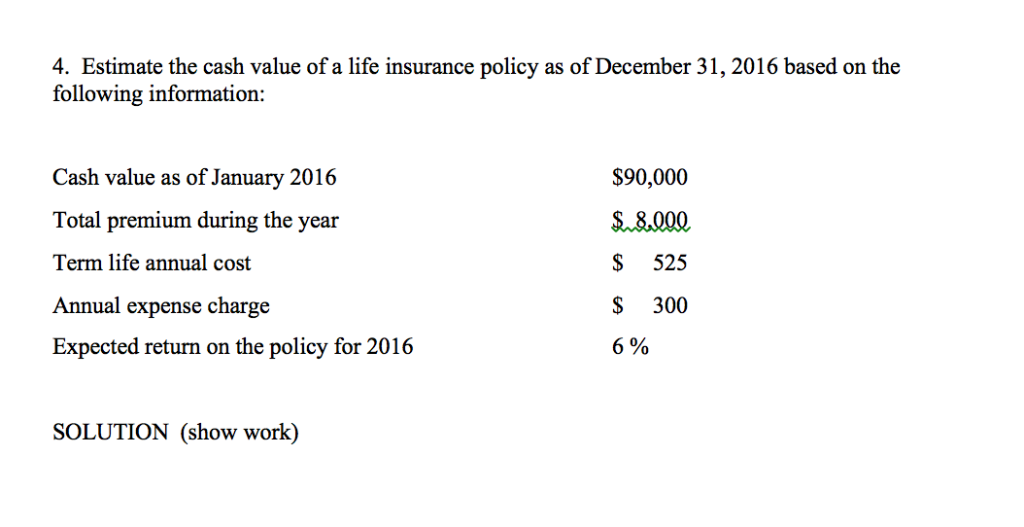

4 Estimate The Cash Value Of A Life Insurance Pol Chegg Com

4 Estimate The Cash Value Of A Life Insurance Pol Chegg Com

Life Insurance In Depth Custom Wealth Management

Life Insurance In Depth Custom Wealth Management

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Term Vs Cash Value Life Insurance What Do You Need

Term Vs Cash Value Life Insurance What Do You Need

Why You Should Not Expect Returns From Life Insurance Policies

Why You Should Not Expect Returns From Life Insurance Policies

Cash Value Life Insurance Policy

Cash Value Life Insurance Policy

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Cash Value In Life Insurance What Is It

Cash Value In Life Insurance What Is It

What Is Cash Value On A Life Insurance Policy Mean Funds Pay

What Is Cash Value On A Life Insurance Policy Mean Funds Pay

Alternative To Cash On The Balance Sheet The Living Benefits Of

Alternative To Cash On The Balance Sheet The Living Benefits Of

Mass Mutual Review Amazing Whole Life Insurance

Mass Mutual Review Amazing Whole Life Insurance

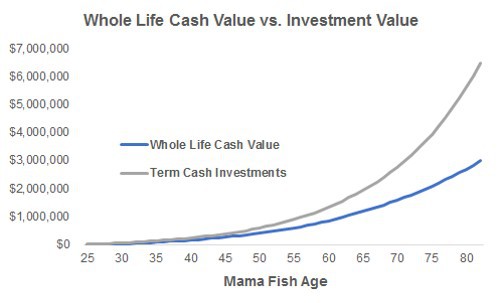

Whole Vs Term Life Insurance Let S Do The Math Smart Money Mamas

Whole Vs Term Life Insurance Let S Do The Math Smart Money Mamas

New York Life Insurance Company Reviews How To Calculate Cash

New York Life Insurance Company Reviews How To Calculate Cash

Post a Comment for "Cash In Value Life Insurance"