Can You Cash In Term Life Insurance

Can you cash in term life insurance. Or you can call the insurance company to cancel your policy.

Permanent life insurance policies build a.

Can you cash in term life insurance. How to sell your term life insurance policy for cash. To cash out a term policy you simply cancel it as there is usually no cash value in a term policy unless you have rop term. After a one month grace period the policy will lapse.

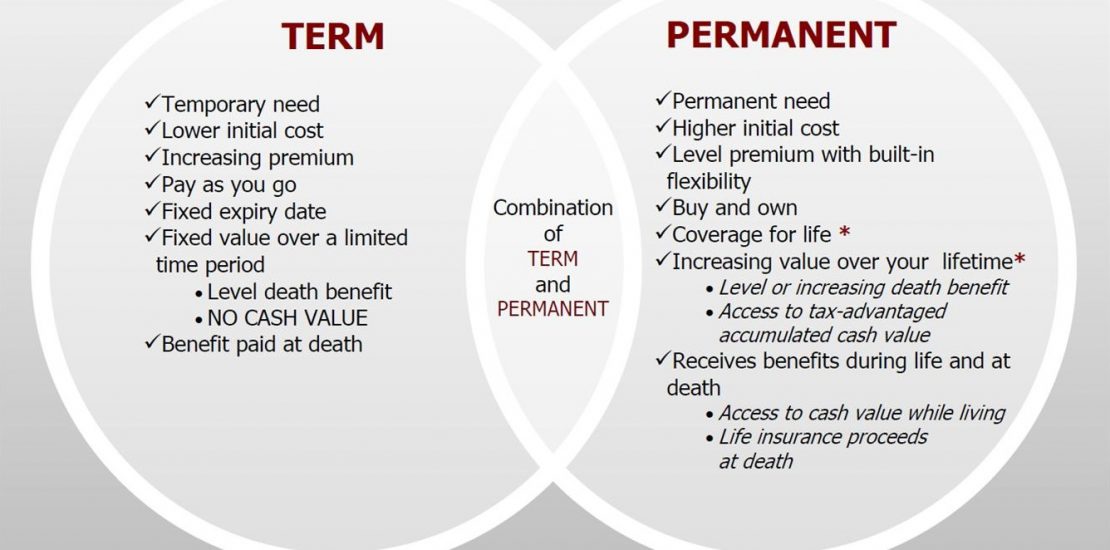

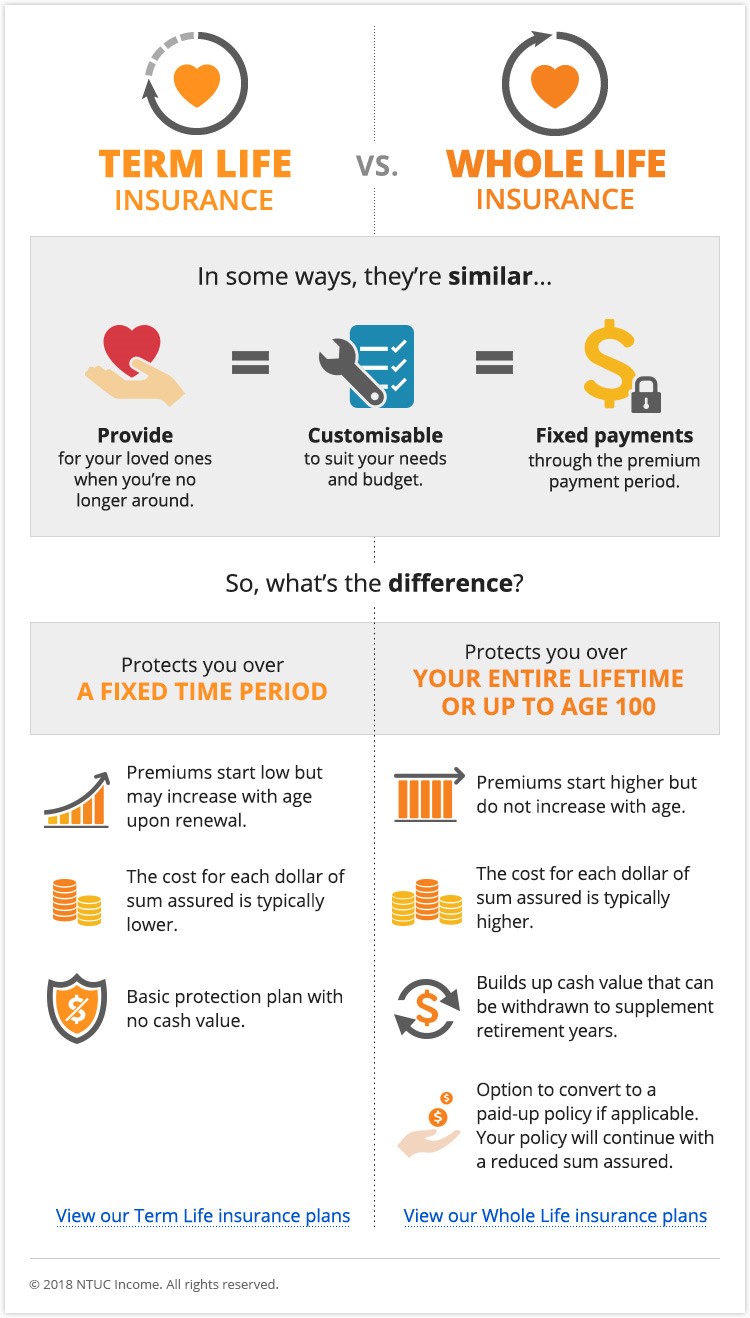

No term life insurance pays a death benefit to your beneficiary if you die within the policys term. Selling a term life insurance policy for cash is possible if your policy is convertible into permanent life insurance. To cancel it you can stop making payments.

The choice can have a number of financial implications including tax liability. Otherwise it does not have any cash value. You can end or not renew a term life insurance policy but it has no cash value at that time.

There are return of premium term policies not so much anymore that if you hold to maturity will return all the premiums paid into the policy. Normal term policies do not build any cash value and the cost can become prohibitive if coverage is still needed after the policy term. Once converted a life settlement provider can then make an offer based on your age health type of insurance premiums and death benefit.

There are certainly drawbacks to using life insurance to meet immediate cash needs especially if youre compromising your long term goals or your familys financial future. Only permanent life insurance such as whole life universal life and variable life has a cash value account that grows over time tax deferred. Horace mann life insurance company writes a cash value term cvt policy.

You can cash in your life insurance at any time as long as the policy has a cash value. Whether to cash in a life insurance policy is an important decision. Then you can access the cash value in the policy using one of the methods listed here.

The cvt policy allows you to receive the cash value if you no longer need the coverage. Term life insurance covers you for a specified number of years and does not feature a cash account when youre paid up which means you have enough cash value to cover your premium payments you can terminate the policy and take the cash. If you have term life insurance you may be allowed to contact your life insurance carrier and convert your term coverage into a lesser amount of paid up coverage.

So technically you cannot cash in term insurance because you dont receive anything. Outside of a refund of unapplied premium there is no cash values to be found in a true term policy. Here are some factors to consider before.

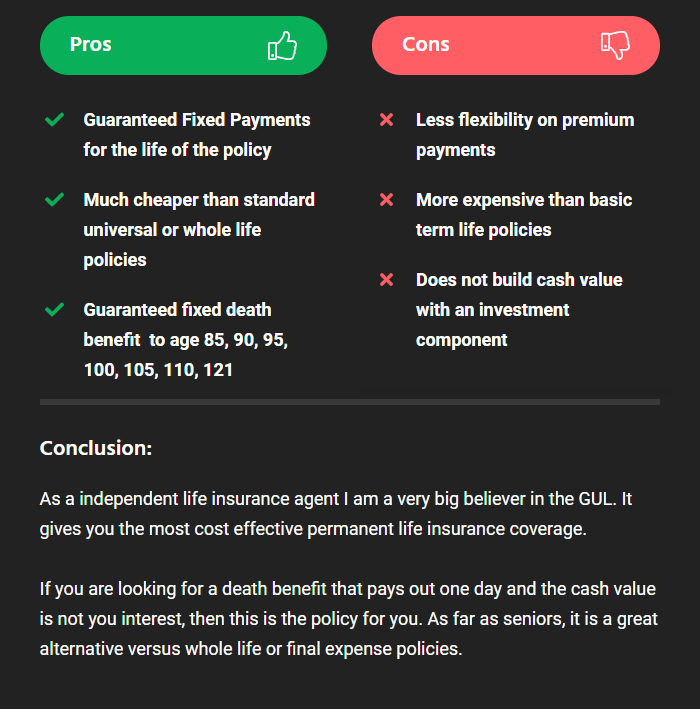

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

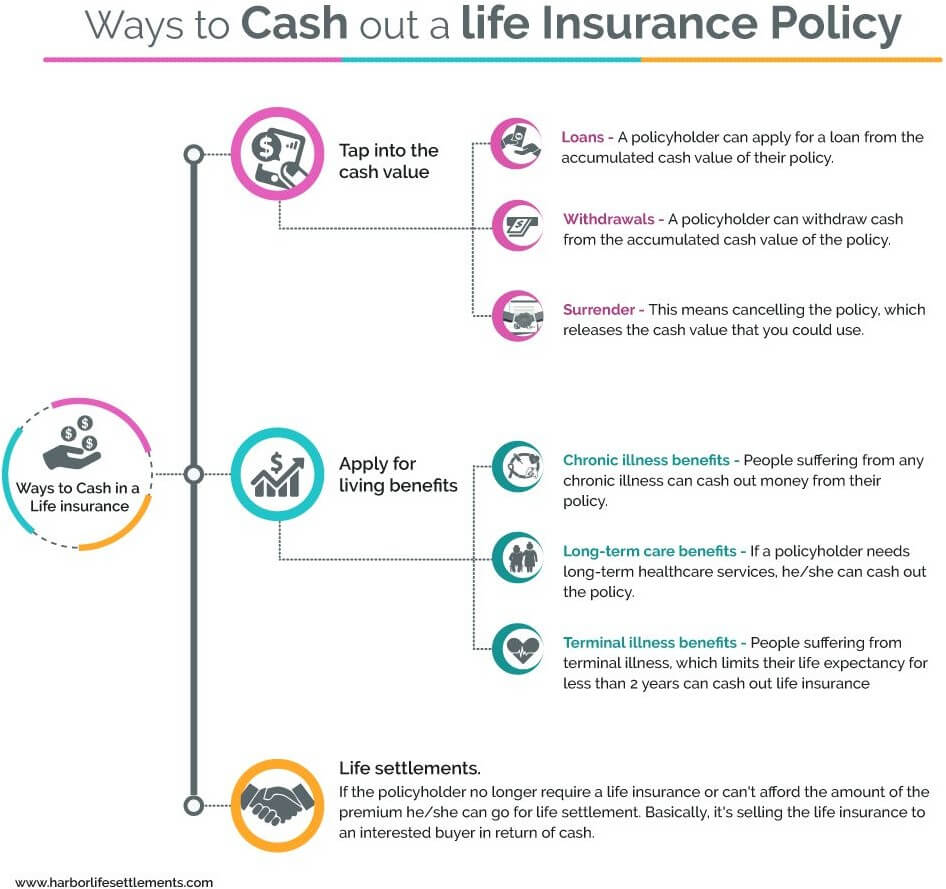

What To Know About Cashing Out Life Insurance Harbor Life

What To Know About Cashing Out Life Insurance Harbor Life

What Will Be The Free Look Period In Life Insurance Policies And Why

What Will Be The Free Look Period In Life Insurance Policies And Why

The Cost Of Life Insurance Policygenius

The Cost Of Life Insurance Policygenius

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates

What Is Term Life Insurance Life Insurance Us News

What Is Term Life Insurance Life Insurance Us News

Term Life Insurance How Term Life Insurance Works Insurance

Term Life Insurance How Term Life Insurance Works Insurance

Term Life Insurance Definition

Term Life Insurance Definition

Comparing The Cost Of Permanent Term Life Insurance Life Happens

Comparing The Cost Of Permanent Term Life Insurance Life Happens

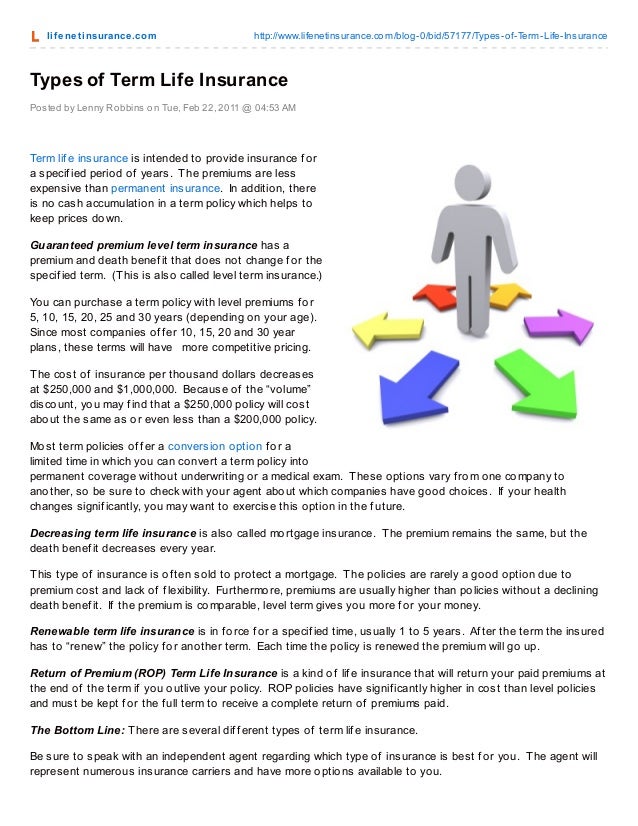

Types Of Term Life Insurance Lifenet Insurance Solutions

Types Of Term Life Insurance Lifenet Insurance Solutions

Is Life Insurance A Smart Investment

Is Life Insurance A Smart Investment

Life Insurance Basics M Financial

Life Insurance Basics M Financial

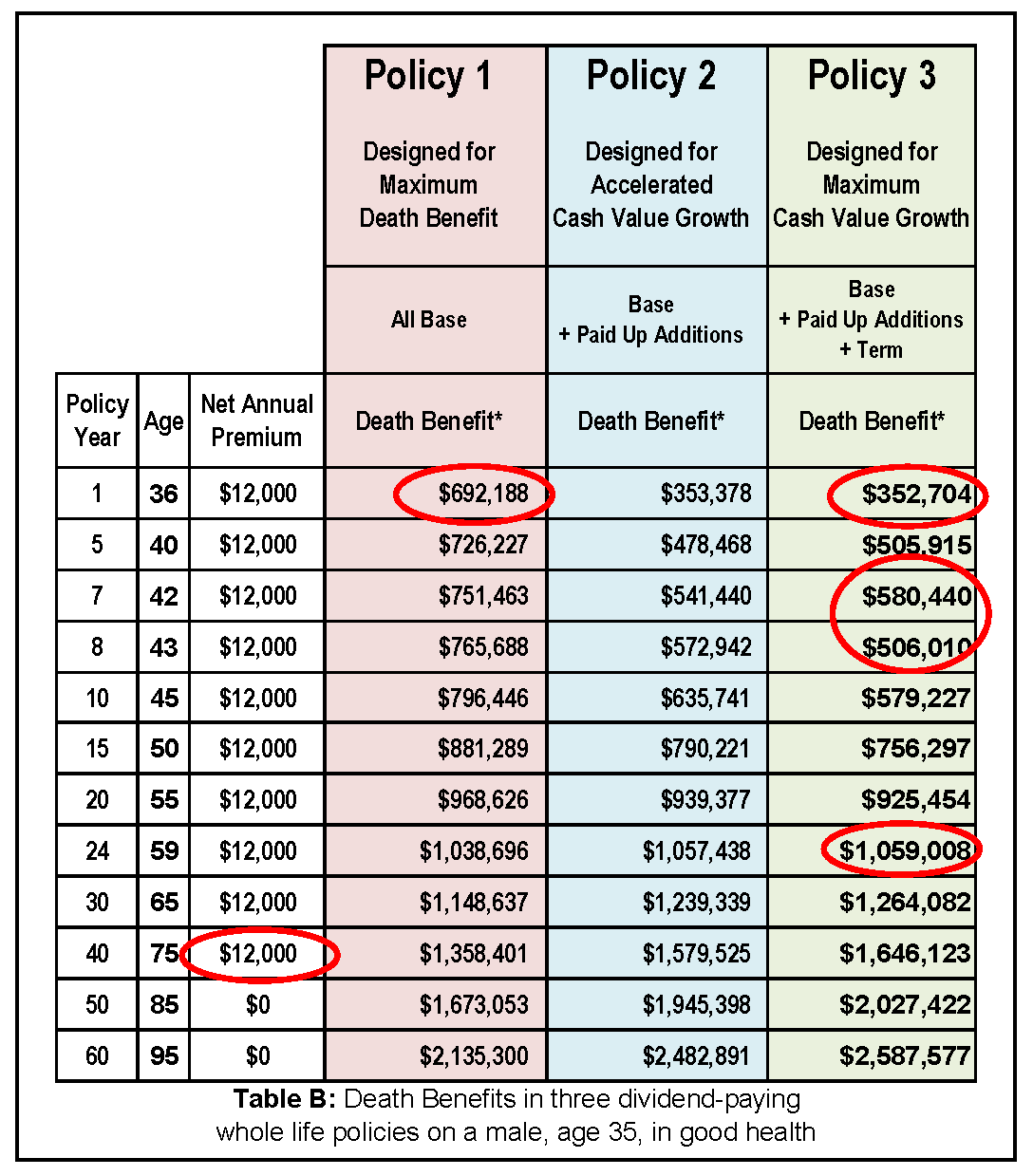

Paid Up Additions Work Magic In A Bank On Yourself Plan

Paid Up Additions Work Magic In A Bank On Yourself Plan

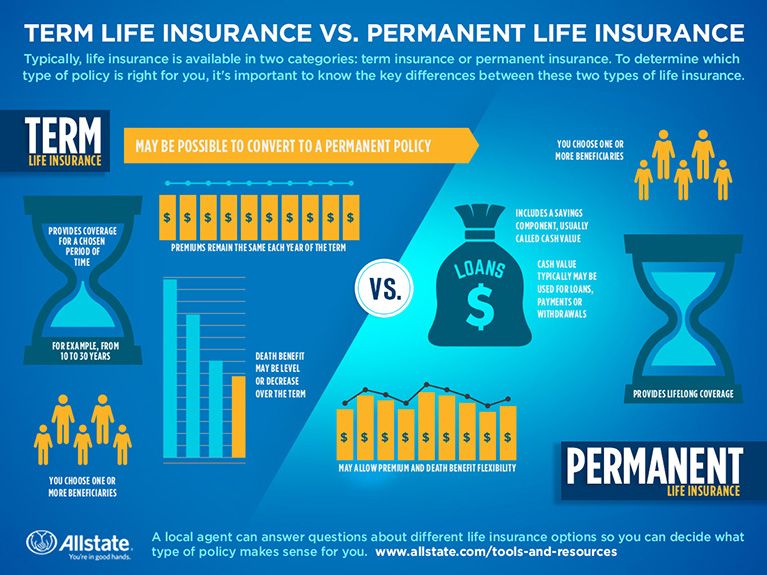

Permanent Life Insurance 101 What You Need To Know Allstate

Permanent Life Insurance 101 What You Need To Know Allstate

Difference Between Term Universal And Whole Life Insurance

Difference Between Term Universal And Whole Life Insurance

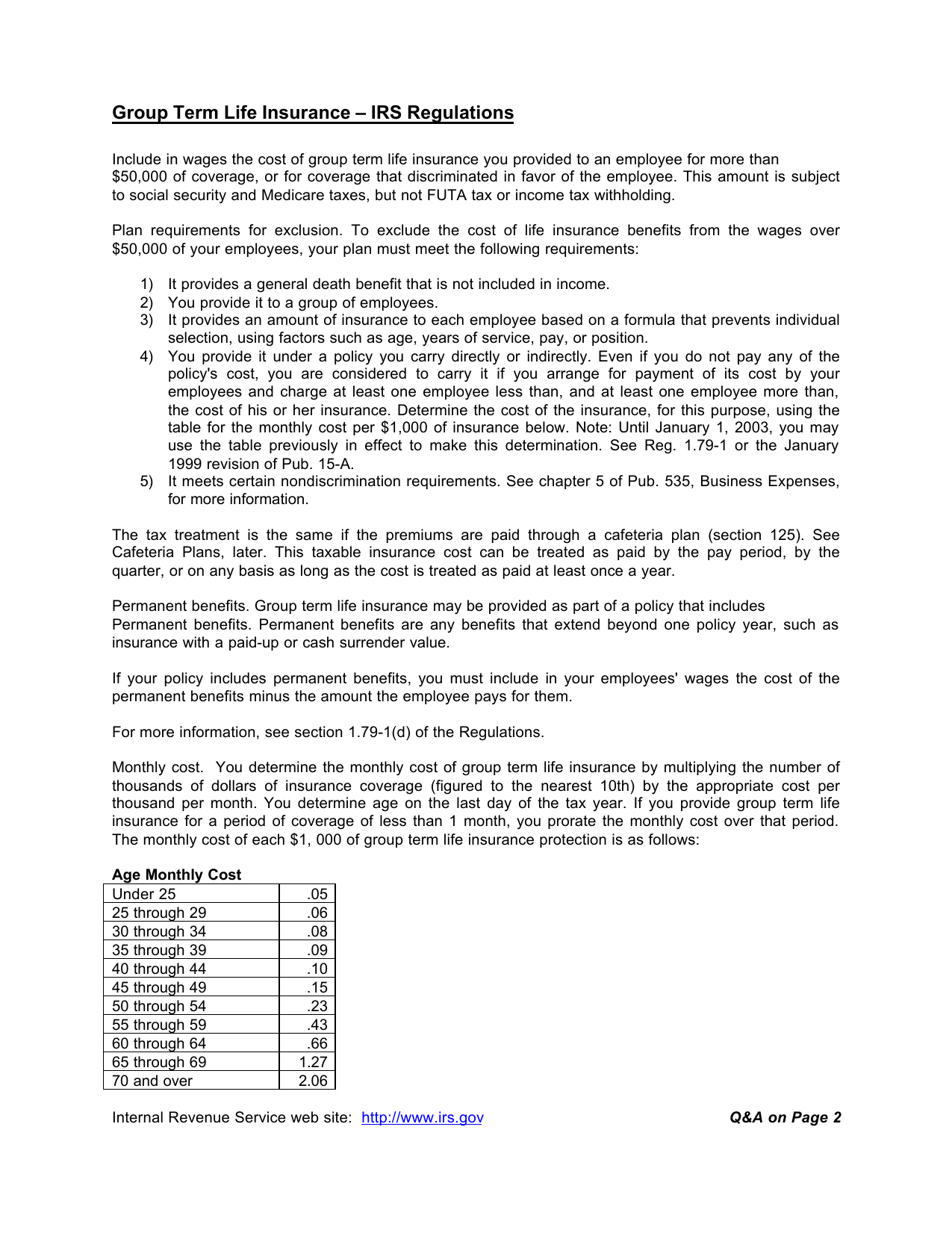

Group Term Life Insurance Irs Regulations

Group Term Life Insurance Irs Regulations

Term Life Insurance Vs Permanent Life Insurance Is Cash Value

Term Life Insurance Vs Permanent Life Insurance Is Cash Value

Term Life Insurance As Well As Disadvantages

Term Life Insurance As Well As Disadvantages

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Term Life Vs Whole Life Insurance Which Type Of Life Insurance

Different Types Of Life Insurance Explanation The Ultimate Guide

Different Types Of Life Insurance Explanation The Ultimate Guide

Post a Comment for "Can You Cash In Term Life Insurance"